The Consumer Federation of America describes Illinois’ current regulatory environment as “toothless” and ranks the state second in the nation for having the fastest-rising insurance premiums in the country.

Photo: CNI file photo

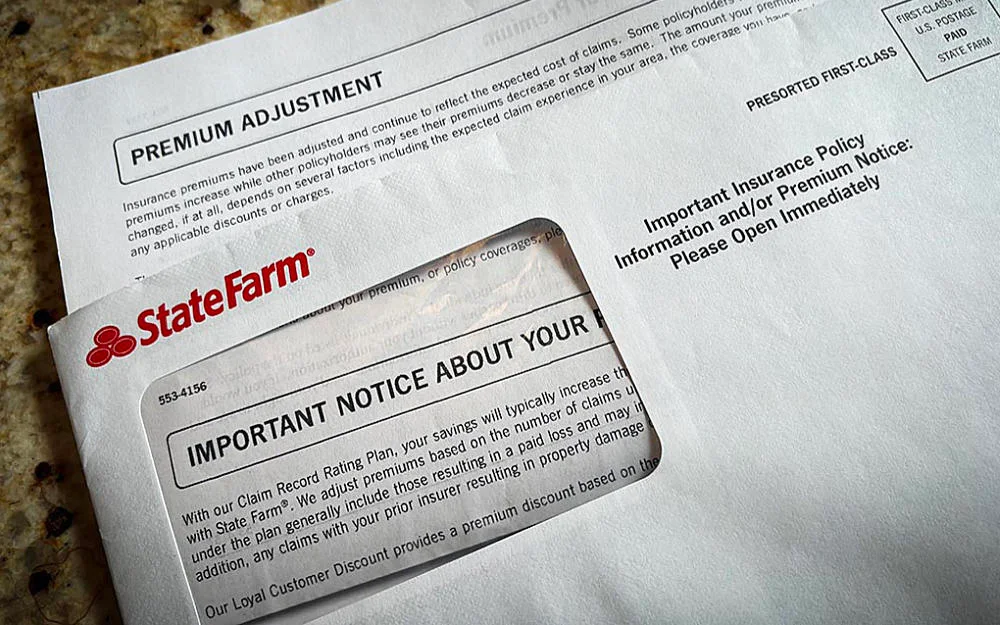

State Farm homeowner premiums will rise by roughly 27% in Illinois, prompting calls for greater regulation by residents around the state.

by Peter Hancock

by Peter Hancock

Capitol News Illinois

Current regulations

Although Pritzker was not specific about what kind of increased regulatory authority he wants lawmakers to consider, some consumer advocates have called for giving the state Department of Insurance broad authority to review, modify or even reject proposed rate hikes. Under current state law, companies are required to file their rates with the Department of Insurance, and the agency can review consumer complaints to determine whether the rates being charged are consistent with those filings. The department also has the authority to conduct examinations to determine whether a company is paying out claims in a timely manner. It can also conduct examinations into a company’s financial condition and solvency. But currently, according to the agency, Illinois is the only state in the country that does not prohibit rates from being “inadequate, excessive or unfairly discriminatory,” which means it has no authority to reject a rate filing on those grounds. Douglas Heller, director of insurance for the Washington-based Consumer Federation of America, described Illinois’ law as “among the most toothless in the nation.” “Almost every state in the country has a law that says for auto, home and most other lines of insurance as well, rates cannot be excessive,” he said in an interview. “Now, it doesn't mean that the regulators around the country do a great job or even have the tools to enforce that very strictly … but Illinois doesn't even have the language that prohibits excessive rates for homeowners insurance companies.” In April, CFA issued a report that said from 2021 to 2024, Illinois ranked second in the nation for having the greatest increases in homeowners insurance premiums. Average premiums in Illinois rose 50% over that period, more than any other state except Utah, where rates went up 59%.

Reasons for rate hikes

In his statement, Pritzker accused State Farm of raising rates in Illinois to cover losses the company has suffered in other high-risk states like Florida. “These increases are predicated on catastrophe loss numbers that are entirely inconsistent with the Illinois Department of Insurance’s own analysis — indicating that State Farm is shifting out-of-state costs onto the homeowners of our state,” he said. “Hard-working Illinoisans should not be paying more to protect beach houses in Florida.” But State Farm strongly denied that suggestion, saying the increases were directly related to the cost of weather-related disasters in Illinois. “For example, last year in the state of Illinois alone, we paid out more than $638 million in hail damage claims,” State Farm spokeswoman Gina Morss-Fischer said in an interview. “That was just in Illinois, and it was second only to the state of Texas. And this is the kind of thing that we've started to see more frequently. “And of course, we're also seeing the increase in replacement costs, longer waits for replacement materials. And these are all things that contribute to the need to make this difficult business decision,” she said.

Capitol News Illinois is a nonprofit, nonpartisan news service that distributes state government coverage to hundreds of news outlets statewide. It is funded primarily by the Illinois Press Foundation and the Robert R. McCormick Foundation.