According to a report released by U.S. Mortgage Insurers (USMI), 64% of homebuyers who used private MI last year did so to purchase their first homes and to begin building equity, a 6% increase in first-time buyers' share of the market from 2020. Considering a 20% down payment on the national median home price of approximately $425,000 is $85,000, many aspiring homeowners without the resources to make large cash down payments understandably choose private MI. After all, putting 5% down on that same home requires saving only $21,000 in comparison. USMI reports that 35% of homebuyers using private MI in 2023 had annual incomes lower than $75,000. "Private MI remains one of the most helpful tools available to first-time and low- to moderate-income buyers in the market. Private MI helps borrowers overcome the large down payment barrier to affordably and sustainably qualify for financing and start reaping the benefits of homeownership years earlier," said USMI Board Chairman and Enact President and CEO Rohit Gupta. In 2023, private MI helped 800,000 buyers purchase homes using low down payment mortgages, and 39 million homebuyers have achieved this cornerstone of the American dream with private MI since it was first introduced. If a 20% down payment were required, it would take the average homebuyer 27 years to save for the down payment and closing costs, three times longer than the time it would take to save for the 5% down payment that is often used with private MI. Fortunately, you don't need a 20% down payment to become a homeowner. USMI President Seth Appleton described the role that private MI plays for housing affordability and access as "opening the homebuying experience up to working families, including first-time buyers. People do not need to save for 20, 30 and even 40 years to meet the mythical - but not required - 20% down payment threshold to be able to afford their first house; instead, millions of homebuyers have achieved the American dream of homeownership and started building their wealth and equity by using private MI." Another advantage for homebuyers, according to USMI, is that private MI is a temporary cost; monthly borrower-paid MI can cancel after the homeowner establishes sufficient equity either through regular payments or home price appreciation. When mortgage insurance is canceled, the borrower's monthly overall payment goes down. There are many financing options for homebuyers to consider. Learn how you might be able to use private MI to start your homebuying process at lowdownpaymentfacts.com, a resource launched by USMI to offer homebuyers low down payment mortgage information and dispel the myth that a 20% down payment is required to become a homeowner.

Money Matters |Low down payment mortgages help first-time home buyers

According to a report released by U.S. Mortgage Insurers (USMI), 64% of homebuyers who used private MI last year did so to purchase their first homes and to begin building equity, a 6% increase in first-time buyers' share of the market from 2020. Considering a 20% down payment on the national median home price of approximately $425,000 is $85,000, many aspiring homeowners without the resources to make large cash down payments understandably choose private MI. After all, putting 5% down on that same home requires saving only $21,000 in comparison. USMI reports that 35% of homebuyers using private MI in 2023 had annual incomes lower than $75,000. "Private MI remains one of the most helpful tools available to first-time and low- to moderate-income buyers in the market. Private MI helps borrowers overcome the large down payment barrier to affordably and sustainably qualify for financing and start reaping the benefits of homeownership years earlier," said USMI Board Chairman and Enact President and CEO Rohit Gupta. In 2023, private MI helped 800,000 buyers purchase homes using low down payment mortgages, and 39 million homebuyers have achieved this cornerstone of the American dream with private MI since it was first introduced. If a 20% down payment were required, it would take the average homebuyer 27 years to save for the down payment and closing costs, three times longer than the time it would take to save for the 5% down payment that is often used with private MI. Fortunately, you don't need a 20% down payment to become a homeowner. USMI President Seth Appleton described the role that private MI plays for housing affordability and access as "opening the homebuying experience up to working families, including first-time buyers. People do not need to save for 20, 30 and even 40 years to meet the mythical - but not required - 20% down payment threshold to be able to afford their first house; instead, millions of homebuyers have achieved the American dream of homeownership and started building their wealth and equity by using private MI." Another advantage for homebuyers, according to USMI, is that private MI is a temporary cost; monthly borrower-paid MI can cancel after the homeowner establishes sufficient equity either through regular payments or home price appreciation. When mortgage insurance is canceled, the borrower's monthly overall payment goes down. There are many financing options for homebuyers to consider. Learn how you might be able to use private MI to start your homebuying process at lowdownpaymentfacts.com, a resource launched by USMI to offer homebuyers low down payment mortgage information and dispel the myth that a 20% down payment is required to become a homeowner.

New smoke detector law goes into effect on January 1 in Illinois

SPRINGFIELD -- In two weeks, Illinois' updated Smoke Alarm Law goes into effect across the state. The new provisions, which applies to homes built before 1988, require any smoke alarm being installed within a single or multi-family home be replaced with models that have a sealed, non-removable 10-year battery. "With a long-term 10-year battery smoke alarm, there is no need for battery replacement, saving the average homeowner between $40-$60 in battery costs over the life of each alarm," says Phil Zaleski, Executive Director for the Illinois Fire Safety Alliance. "At the end of the 10-year life cycle, the smoke alarm will automatically alert the homeowner to replace the alarm."

He added that, "While many people deactivate their older model smoke alarms or remove the batteries while cooking, the 10-year model is not a cooking nuisance and has a 15-minute silencer button.

Zaleski said in a release that required model is "very affordable with the current retail price being about $15 and as low as $10 if you buy them in bulk."

A quick on search on Amazon today shows 10-year, tamper-proof models retailing as low as $13 each. Order a six-pack, and the price drops to $8.33 each.

Passed in 2017, Public Act 100-0200 required all Illinois homes to have a smoke alarm with the extended-life battery by the first of next month. The bill states that "Every dwelling unit or hotel shall be equipped with at least one approved smoke detector in an operating condition within 15 feet of every room used for sleeping purposes. The detector shall be installed on the ceiling and at least 6 inches from any wall, or on a wall located between 4 and 6 inches from the ceiling."

To avoid ‘false alarms’ from the new detectors, they should not be placed within 15 feet of a stove or within 3 feet of bathrooms because of the humidity to avoid tripping the alarm.

Alarms already installed in dwellings are exempt if the manufactured date is less than 10-years old on date of inspection, does not fail testing, and is in proper operating condition. Residents or landlords replacing smoke detectors that are not hardwired in the home must do so with the new 10-year model. Homes with hardwired systems or systems connected to remote monitoring services are also exempt.

There were 97 residential fire deaths in Illinois in 2021, and nearly 70% of those deaths happened in homes without a working smoke alarm, according to Margaret Vaughn, Illinois Fire Safety Alliance and Illinois Fire Association government affairs director.

According to the bill, homeowners without an updated alarm will get a 90-day notice to install a sealed battery model. After that, they can be fined up to $100 every 30 days until the correct alarm(s) are installed. Also, homeowners and landlords should note the law makes it a Class B misdemeanor to not have a working smoke detector installed as required.

He added that, "While many people deactivate their older model smoke alarms or remove the batteries while cooking, the 10-year model is not a cooking nuisance and has a 15-minute silencer button.

Zaleski said in a release that required model is "very affordable with the current retail price being about $15 and as low as $10 if you buy them in bulk."

A quick on search on Amazon today shows 10-year, tamper-proof models retailing as low as $13 each. Order a six-pack, and the price drops to $8.33 each.

Passed in 2017, Public Act 100-0200 required all Illinois homes to have a smoke alarm with the extended-life battery by the first of next month. The bill states that "Every dwelling unit or hotel shall be equipped with at least one approved smoke detector in an operating condition within 15 feet of every room used for sleeping purposes. The detector shall be installed on the ceiling and at least 6 inches from any wall, or on a wall located between 4 and 6 inches from the ceiling."

To avoid ‘false alarms’ from the new detectors, they should not be placed within 15 feet of a stove or within 3 feet of bathrooms because of the humidity to avoid tripping the alarm.

Alarms already installed in dwellings are exempt if the manufactured date is less than 10-years old on date of inspection, does not fail testing, and is in proper operating condition. Residents or landlords replacing smoke detectors that are not hardwired in the home must do so with the new 10-year model. Homes with hardwired systems or systems connected to remote monitoring services are also exempt.

There were 97 residential fire deaths in Illinois in 2021, and nearly 70% of those deaths happened in homes without a working smoke alarm, according to Margaret Vaughn, Illinois Fire Safety Alliance and Illinois Fire Association government affairs director.

According to the bill, homeowners without an updated alarm will get a 90-day notice to install a sealed battery model. After that, they can be fined up to $100 every 30 days until the correct alarm(s) are installed. Also, homeowners and landlords should note the law makes it a Class B misdemeanor to not have a working smoke detector installed as required.

The Long-Term Costs of Overlooking Home Repairs

by Casey Cartwright

by Casey Cartwright Contributing Writer

When a homeowner discovers a small leak under their sink or a few cracked shingles on their roof, they may consider them to be minor issues they can address later. However, delaying these fixes can have significant consequences.

Understanding the long-term costs of overlooking home repairs is crucial for protecting what can be a person's most significant financial investment. From escalating repair bills to potential health hazards, the actual price of procrastination often far exceeds the initial cost of a timely fix.

Higher Repair Bills

A small problem rarely stays small, and minor fixes left unattended often grow into much bigger and more expensive issues. For example, what begins as a tiny water leak under the sink or a few cracked shingles on the roof can seem harmless at first, but over time, persistent moisture can seep into subflooring, drywall, and structural beams.

This leads to wood rot, crumbling walls, and weakened structural integrity, often requiring major renovations that involve replacing entire sections of flooring, walls, or cabinetry. This example shows how delayed repairs can become more complex and expensive as secondary damage accumulates, making prompt attention to minor issues a wise and necessary investment.

Compromised Resale Value

Another long-term cost of overlooking home repairs is compromised resale value. When it comes time to sell your home, you will likely have home inspectors visit your residence to see if they can find any problems. These professionals have the training and expertise to spot signs of long-term neglect, and their findings can result in you lowering your price or finding it more challenging to sell your property.

For instance, issues like rodent infestations can have a negative impact on property values. This makes it essential to address these matters well before a home inspector visits your property.

Escalating Utility Costs

Neglecting necessary repairs can lead to higher monthly utility costs. Poorly sealed windows and doors, aging insulation, or gaps in the building envelope force heating and cooling systems to run constantly to maintain a comfortable temperature. A drafty home is an expensive home.

Likewise, a leaking faucet can waste hundreds of gallons of water per month, increasing your water bill. Although you may not notice these gradual increases in utility spending at first, they can be incredibly costly to your finances. Over the course of a year, they can represent a significant financial drain that you could have easily prevented with basic repairs.

Reduction of Vital Resources

Failing to address home repairs can also result in wasted resources, such as water and energy. Letting your faucet leak or your toilet run can waste thousands of gallons of water each year, straining both household budgets and community water supplies.

Additionally, when you delay repairs, damage typically worsens and may require more materials to fix than if addressed early, adding unnecessary strain to manufacturing and supply chains. Taken together, these wasted resources contribute to a larger environmental footprint and hinder efforts to create more sustainable, resilient communities.

Health and Safety Risks

Overlooking home repairs can also create serious health and safety hazards for you and your family. For example, persistent moisture from leaks fosters the growth of mold and mildew, which can release spores into the air that trigger allergies, asthma, and other respiratory problems.

Faulty electrical wiring also presents a constant fire risk, while unstable railings or rotting steps can lead to dangerous falls. Even something as simple as a clogged dryer vent can become a fire hazard if you allow lint to build up. Protecting your family's well-being is perhaps the most compelling reason to address home repairs promptly.

Voided Insurance and Warranty Claims

Many homeowners assume their insurance policies will cover major disasters, but that coverage often depends on responsible maintenance. Insurance providers can deny claims if they determine that the damage resulted from a homeowner's failure to address a known issue.

For instance, if a roof collapses due to damage from a leak that you ignored for months, the insurer may argue that negligence was the cause and refuse to pay for the repairs. Similarly, warranties for appliances, roofing, and other home components often require regular maintenance to remain valid. Neglecting these duties can void the warranty, leaving you fully responsible for replacement costs.

Loss of Comfort and Enjoyment

Living in a home that is in constant need of repair affects more than just finances—it can diminish your daily comfort and enjoyment. Drafts from inefficient windows, noises from faulty appliances, or unsightly stains and damages can make the living environment less pleasant for everyone residing in the home.

If you ignore these minor annoyances, they can become significant sources of stress and frustration over time. Continual disruptions caused by avoidable emergencies distract from the comfort and peace that a well-maintained home should provide.

Strained Relationships and Mental Well-Being

The burden of postponed repairs extends into homeowners’ mental and emotional well-being. When home issues pile up, they may become a frequent topic of stress or disagreement among family members.

Constant reminders of unfinished tasks can generate anxiety and tension, impacting relationships within the household. Sustained periods of living amid unrepaired issues can erode satisfaction with the home. Additionally, in some cases, they can contribute to feelings of embarrassment when hosting guests, ultimately diminishing the quality of life for everyone involved.

Ripple Effects Within Communities

Neglecting home repairs can also have a ripple effect across the entire community. A single poorly maintained house often stands out and may drag down the property values of neighboring homes.

Visible deterioration, such as peeling paint, overgrown landscaping, or structural damage, creates an impression of neglect that can discourage potential buyers and new residents. Furthermore, unresolved issues such as loose railings, broken sidewalks, or exposed wiring can pose safety risks to neighbors and visitors, increasing the odds of accidents.

When homeowners take responsibility for maintenance, they help preserve the safety, appearance, and vitality of their neighborhoods. This fosters a stronger sense of pride and cohesion throughout the community.

Addressing home repairs as they arise is not just about fixing a problem; it is about responsible stewardship of your property. Ignoring small issues allows them to grow into complex, expensive crises that can harm your home, your health, and even the planet. By adopting a proactive approach to maintenance, homeowners can protect their investment and ensure their home remains a safe and valuable asset for years to come.

More Home Improvement Stories

Are you ready for when your power goes out?

Staying warm in the winter, and comfortable all year long

Their advanced smart technology allows the user to set customized, true room-by-room comfort with individually controlled indoor options. Quiet and efficient, a mini-split transforms a garage into a functional extension of the home.

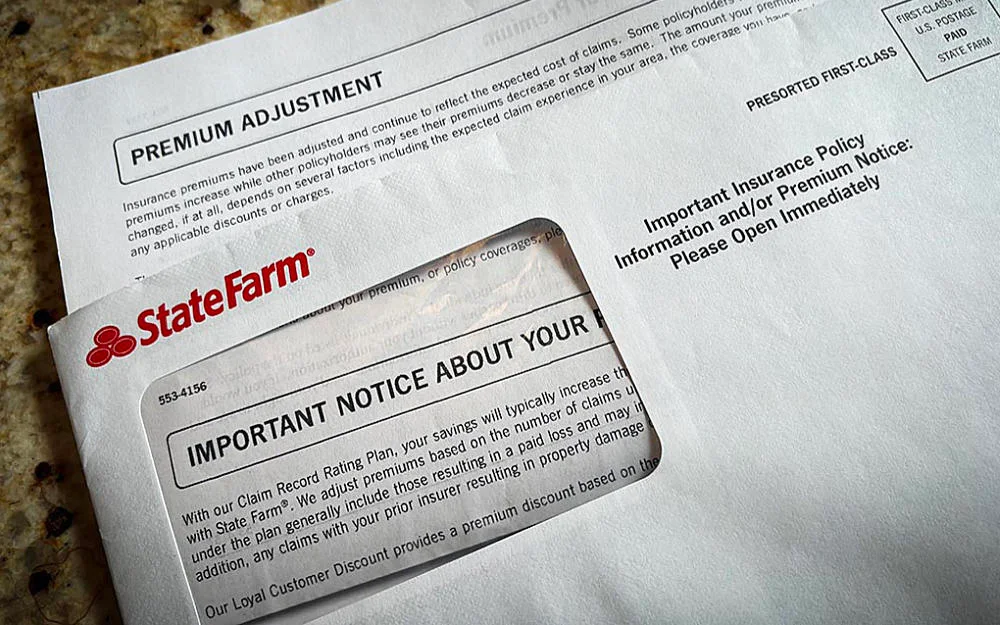

Pritzker seeks more regulatory authority over homeowners insurance business

by Peter Hancock

by Peter Hancock

Capitol News Illinois

Current regulations

Although Pritzker was not specific about what kind of increased regulatory authority he wants lawmakers to consider, some consumer advocates have called for giving the state Department of Insurance broad authority to review, modify or even reject proposed rate hikes. Under current state law, companies are required to file their rates with the Department of Insurance, and the agency can review consumer complaints to determine whether the rates being charged are consistent with those filings. The department also has the authority to conduct examinations to determine whether a company is paying out claims in a timely manner. It can also conduct examinations into a company’s financial condition and solvency. But currently, according to the agency, Illinois is the only state in the country that does not prohibit rates from being “inadequate, excessive or unfairly discriminatory,” which means it has no authority to reject a rate filing on those grounds. Douglas Heller, director of insurance for the Washington-based Consumer Federation of America, described Illinois’ law as “among the most toothless in the nation.” “Almost every state in the country has a law that says for auto, home and most other lines of insurance as well, rates cannot be excessive,” he said in an interview. “Now, it doesn't mean that the regulators around the country do a great job or even have the tools to enforce that very strictly … but Illinois doesn't even have the language that prohibits excessive rates for homeowners insurance companies.” In April, CFA issued a report that said from 2021 to 2024, Illinois ranked second in the nation for having the greatest increases in homeowners insurance premiums. Average premiums in Illinois rose 50% over that period, more than any other state except Utah, where rates went up 59%.

Reasons for rate hikes

In his statement, Pritzker accused State Farm of raising rates in Illinois to cover losses the company has suffered in other high-risk states like Florida. “These increases are predicated on catastrophe loss numbers that are entirely inconsistent with the Illinois Department of Insurance’s own analysis — indicating that State Farm is shifting out-of-state costs onto the homeowners of our state,” he said. “Hard-working Illinoisans should not be paying more to protect beach houses in Florida.” But State Farm strongly denied that suggestion, saying the increases were directly related to the cost of weather-related disasters in Illinois. “For example, last year in the state of Illinois alone, we paid out more than $638 million in hail damage claims,” State Farm spokeswoman Gina Morss-Fischer said in an interview. “That was just in Illinois, and it was second only to the state of Texas. And this is the kind of thing that we've started to see more frequently. “And of course, we're also seeing the increase in replacement costs, longer waits for replacement materials. And these are all things that contribute to the need to make this difficult business decision,” she said.Hours and guidelines set for Halloween 2020 in St. Joseph

We are asking those participating in giving out candy this year to get creative in how they deliver candy to the trick or treaters. The trick or treaters can submit those homes to the Village office on the Monday after Halloween," Mayor Tami Fruhling-Voges said in a release today. "I thought this would be fun to encourage social distancing while distributing candy. The village has some very creative community members that hopefully will enjoy coming up with something."

Homeowners and trick-or-treaters are encouraged submit a photos with a description of the delivery system. The village will also accept description of how homeowners handed out candy and treats to trick-or-treaters if they are unable to print a photo in time. The description should the address and homeowners name if possible."

Entries can be submitted through the Village office overnight slot by the front door or in-person during regular Village office hours. They may also be sent via emailed to mayor@stjosephillinois.org.

With guidance from the Champaign-Urbana Public Health District, the Village President said the board will make an official proclamation at the next meeting to allow trick-or-treating on Saturday, October 31, from 6pm and 8pm.

Here is the complete list of guidance from the Village to help make this Halloween fun and safe for the community:

COVID-19 TRICK-OR-TREATING GUIDELINES

"Trick-or-treating hours in the Village of St. Joseph will be from 6-8 p.m. on Saturday, October 31. The use of face coverings, hand sanitizer, and social distancing (at least 6 feet) from others will always be required (per IDPH Guidelines), when outdoors while participating or chaperoning."Trick-or-treating will be challenging amid the ongoing COVID-19 pandemic this year and may look different from previous Halloweens. However, for those who ARE welcoming trick-or-treaters to their home, leave your porch lights on to indicate you are participating. If you do not have a porch light, place a clearly marked sign welcoming trick-or-treaters or indicating you are not participating. For trick-or-treaters, if you do not see a home with a porch light on or a sign posted, we ask that you respect the wishes of those homeowners by bypassing those residences.

"If you and your family do decide to trick-or-treat this Halloween, here are a few guidelines to follow that will help protect our community and accommodate a safe Halloween experience for both participants and non-participants:

Trick-or-Treaters and Those Giving Candy:

"If you have COVID-19, developed symptoms consistent with COVID-19, are under quarantine, have been exposed to someone with COVID-19, or are in a higher risk category, you should not participate in in-person Halloween festivities. 1. Wear a mask – Incorporate a mask or face covering into your costume. Please remember that rubber or plastic masks do not offer any protection from the virus, so have a protective cloth mask layered into a costume’s decorative mask. 2. Practice good hand hygiene – If you choose to go house to house for trick-or treating or give treats, be prepared to practice good hand hygiene. Bring along hand sanitizer to use before you move from one location to another. A suggestion for those giving treats; give to a single person to limit contact with others. Also wash your hands as frequently as possible. 3. Maintain social distances – While it is fun to go trick-or-treating with friends, due to the COVID-19 risk, keep the group limited to family members who are within your protected “bubble”. Gathering in groups with people from outside your household increases the risks. When you are walking around with your child, you do not want to go into a big group of people or into crowded areas. Please remember that keeping social distance (at least 6 feet) from others is important to limiting the spread of the virus. Those passing out treats consider alternative ways to limit contact with trick-or-treaters. Be creative and inventive! *The Village is sponsoring a contest to see who can create the safest, imaginative, and clever way to deliver your candy. Encourage your trick-or-treaters to nominate your home and delivery system to the Village office on Monday. Nominations can be written on a piece of paper and placed in the overnight mail slot or dropped off on Monday. The winner will receive a gift card from one of our local businesses. 4. Avoid “Face to Face” exposure – Interactions at any given doorway or front porch should be very brief and as limited as possible, which will help reduce the risk of exposure. Trick-or-treaters and those giving candy should always wear their mask. 5. Avoid eating candy while trick or treating – Encourage trick-or-treaters to be sure hands have been sanitized before opening and eating candy. Those giving out candy can consider this a diet saver. Wash Your Hands Frequently!! 6. Porch light must be on – If a homeowner is participating, they will keep their porch light on. If they do not have a porch light, they will have a clearly marked sign welcoming trick-or-treaters or indicating they are not participating. This is long-standing basic Halloween etiquette. If no light is on, do not go to that home. A yard light, common in many subdivisions, that usually comes on automatically at dusk is not considered a porch light and should not be an indication that it is ok to go to your door. Those Not Participating Keep Your Porch Light Off!! If Your Porch Light Cannot Be Shut Off, clearly mark Your Porch or Front Door "NO TRICK OR TREATING"!! AS ALWAYS DRIVE SAFELY, USE THE SIDEWALKS, BRING A FLASHLIGHT, AND LOOK BEFORE CROSSING THE STREET. HAVE A SAFE AND HAPPY HALLOWEEN!" Tami Fruhling-Voges, Village President and The St. Joseph Village Trustees."Looking past the charm: How to evaluate that older house you want to buy

Older homes often attract buyers through character, layout, and established neighborhoods. Of course, charm should never outweigh careful evaluation. First-time buyers should look for practical signs that reveal how the home truly functions. Early decisions affect comfort, safety, and finances for decades. Many older houses appear updated but hide aging systems. Besides, surface upgrades rarely fix deeper issues. Paint and fixtures can distract from costly problems below. This guide explains what buyers should look for before making a serious offer. Clear knowledge builds confidence and prevents expensive mistakes.

The Structure Beneath the Charm

Structure determines whether a home stands strong or if it needs a renovation. In contrast, visual appeal offers little protection against foundation problems. Buyers should inspect walls, floors, and ceilings for movement signs. Cracks wider than a coin deserve professional review. Uneven floors often indicate settlement or moisture issues. Nevertheless, some movement is common in older homes. The concern lies in ongoing or uneven shifting. Basement walls, support beams, and crawl spaces reveal important clues. These areas show how the home has aged. Moisture damage weakens the structure over time. Similarly, past water intrusion leaves stains, crumbling mortar, or warped framing. Buyers should check for musty odors and efflorescence. These signs often point to drainage or grading problems outside.Roof Age and Drainage Performance

The roof protects every system below it. Not to mention, replacement costs strain new homeowner budgets. Buyers should confirm roof age, material, and maintenance history. Asphalt shingles age faster than metal or slate. Drainage plays an equal role in long-term protection. As a result, poor gutter systems cause foundation and siding damage. Downspouts should extend away from the house. Soil should slope outward to prevent pooling near walls. Roof flashing deserves close attention. Likewise, failed flashing allows water entry around chimneys and vents. Interior ceiling stains often trace back to roof weaknesses. Early detection prevents widespread damage.

Relocation is Also Important

A smooth move can influence how you feel about your new home from day one. Older properties, for example, often require extra planning. Narrow hallways make it harder to move large furniture, while tight door frames can slow down appliance delivery. Taking measurements ahead of time for entryways, staircases, and ceiling height keeps everything on track and prevents dents, scratches, or last-minute rearranging. Many families discover that relocating without much hassle comes down to early organization and the right tools. Simple moving hacks that save time and stress include investing in sturdy packing materials so boxes don’t collapse in transit, packing room-by-room instead of mixing items, and using color-coded labels to identify where everything belongs the moment the truck opens. A dedicated first-night box with basics like toiletries, bed sheets, chargers, and snacks brings comfort when you are too tired to unpack. Utility transfers are another often overlooked detail. Older homes may require manual meter readings or separate appointments for water, gas, and electricity setup. Confirm service activation well in advance so you don’t arrive at a cold house or a delayed internet installation. With thoughtful planning, the move feels less chaotic, and your first week in the new home becomes far more manageable.Plumbing Systems That Reveal Hidden Costs

Plumbing upgrades often lag behind visible renovations. Of course, pipe material determines reliability and lifespan. Galvanized steel corrodes internally and reduces water pressure. Copper and modern plastics last longer and perform better. Buyers should test faucets and toilets during inspections. Slow drainage hints at deeper blockages. Older sewer lines may crack or collapse. A camera inspection provides clarity and leverage during negotiations. Water heaters also signal future expenses. In comparison, older units operate less efficiently. Rust, leaks, or age beyond ten years suggest replacement soon. These costs should factor into purchase decisions.Electrical Capacity and Safety Standards

Electrical systems often reflect the home’s original era. Whereas modern homes support higher power demands, older ones may struggle. Limited amperage restricts appliance use and future upgrades. Panel size and breaker condition matter greatly. Wiring type affects safety and insurance approval. Nevertheless, outdated systems still exist in many homes. Knob-and-tube wiring lacks grounding and poses fire risks. Aluminum wiring requires special handling to remain safe. Outlet placement also reveals system age. Similarly, a few outlets lead to extension cord overuse. Grounded outlets protect electronics and occupants. Electrical updates improve safety and resale value.Insulation and Energy Efficiency Gaps

Older homes often lose heat through hidden gaps. Besides, poor insulation raises utility bills year-round. Attics usually show the biggest deficiencies. Buyers should check insulation depth and coverage. Wall insulation varies widely by construction era. In contrast, some older homes contain none at all. Infrared scans identify cold spots and air leaks. These tests guide targeted improvements after purchase. Windows strongly affect energy performance. Likewise, single-pane glass increases heating and cooling costs. Storm windows help but rarely match modern efficiency. Buyers should budget for upgrades if comfort matters.What First-Time Buyers Should Look For During Inspections

Standard inspections may miss age-specific issues. As a matter of fact, first-time buyers should look for inspectors experienced with older homes. These professionals recognize patterns others overlook. Their reports offer deeper insight. Specialized inspections add another protection layer. Not to mention, sewer scopes uncover buried problems. Pest inspections reveal hidden wood damage. Radon testing also matters in older basements. Buyers should attend inspections when possible. Meanwhile, asking questions builds understanding. Inspectors often share maintenance tips and priorities. This guidance proves valuable after closing.Renovation Restrictions and Local Codes

Renovation plans depend on local rules. Of course, historic designations limit exterior changes. Windows, doors, and siding may require approval. Buyers should research restrictions before planning updates. Building codes affect interior work as well. In contrast, older layouts may not meet current standards. Stair widths, ceiling heights, and egress rules matter. Bringing spaces up to code increases project costs. Permit history reveals past work quality. Similarly, unpermitted renovations create legal and safety risks. Buyers should verify permits for major remodeling. This step prevents future complications.

Maintenance Patterns Tell a Story

Maintenance records reveal how owners treated the home. Besides, consistent care signals pride and responsibility. Regular roof, HVAC, and plumbing service reduces surprise failures. Gaps in records raise questions. Deferred maintenance accelerates deterioration. Nevertheless, some issues remain hidden despite good care. Buyers should compare records with inspection findings. Mismatches deserve further investigation. Exterior maintenance matters as much as interior care. Likewise, peeling paint exposes wood to rot. Failing caulk allows moisture entry. These details affect long-term durability.Insurance and Financing Challenges

Older homes face unique insurance hurdles. Of course, outdated systems increase perceived risk. Insurers may require upgrades before issuing policies. Buyers should confirm coverage early. Financing rules also affect purchase options. In comparison, government-backed loans impose stricter property standards. Peeling paint, handrails, and safety issues matter. Buyers should understand lender expectations. Replacement cost coverage deserves attention. Similarly, rebuilding an older home costs more than the market value. Accurate coverage protects against underinsurance. This step safeguards long-term security.Making Confident Choices With Clear Priorities

Older homes reward informed and patient buyers. With careful planning, first-time buyers should look for solid systems over surface beauty. Structure, utilities, and efficiency deserve top priority. Style can follow later. Knowledge reduces fear and regret. In summary, first-time buyers should look for homes that support long-term living, not short-term appeal. Clear evaluation leads to smarter offers. Confidence grows when buyers know what truly matters.How to winterize your home without breaking the bank

SNS - As the temperature drops and the first signs of frost settle in, homeowners begin preparing for winter. But keeping your home warm and protected from the elements doesn’t have to mean draining your bank account. With a little planning and some strategic action, you can winterize your home affordably while still staying cozy and energy-efficient. This guide will walk you through smart, budget-friendly ways to get your home ready for the colder months. Whether you're a new homeowner or a seasoned pro looking to cut costs, there’s something here for everyone. Let’s dive into practical and cost-effective steps that make a big difference.

Seal Drafts Around Doors and Windows

One of the biggest culprits of heat loss is air leakage through windows and doors. Even tiny gaps can let in cold air and make your heating system work overtime. The good news is, sealing these leaks is simple and inexpensive. Weatherstripping tape or foam sealant is widely available and easy to apply yourself. Just run your hand around the edges of windows and doors to feel for any cold spots. Then seal them up. You’ll be surprised how much warmer your home feels with just this one fix.Winterize Your Home: Add Thermal Curtains for Extra Insulation

Curtains aren’t just for privacy or decoration—they can be a powerful line of defense against winter chills. Thermal curtains are designed with insulation layers that help keep warm air inside and block drafts. Hang them over windows in living rooms, bedrooms, and even entryways. They’re affordable, easy to install, and come in various styles that can complement your decor while improving comfort.Give Your Heating System a Check-Up

Before winter hits full force, make sure your heating system is working efficiently. A quick inspection and cleaning can prevent bigger problems down the road. If you have a furnace, replacing the air filter is one of the easiest and cheapest ways to help it run better. Dirty filters restrict airflow, making your system work harder and costing you more in energy bills. You don’t necessarily need a full professional tune-up if you’re trying to save money—just keep things clean, listen for odd noises, and check that vents aren’t blocked.Reverse Your Ceiling Fans

This might surprise you, but your ceiling fan isn’t just for summer. Many models have a small switch that reverses the direction of the blades. When set to spin clockwise at a low speed, the fan gently pushes warm air (which naturally rises) back down into the room. This trick can make a noticeable difference in how warm a space feels, especially in rooms with high ceilings.Use Draft Stoppers at the Bottom of Doors

Even if your doors fit well, cold air can sneak in through the bottom edge. A simple draft stopper, sometimes called a door snake, is a quick fix. You can buy one or make your own with some fabric and rice or beans. Place it at the foot of your door to block those pesky breezes. It’s a low-cost solution that’s surprisingly effective.Insulate Outlets and Switch Plates

Another sneaky source of heat loss is the electrical outlets and switch plates on exterior walls. Cold air can seep in through the gaps around them. For just a few dollars, you can buy foam gaskets that fit behind these plates to reduce drafts. It’s a subtle improvement, but when combined with other measures, it helps keep your rooms warmer and more energy-efficient.Install Window Insulation Film

If your windows are older or single-pane, consider applying a window insulation film. This transparent plastic film sticks directly to your window frame using double-sided tape and a hairdryer to seal it tightly. It creates an insulating barrier that helps keep cold air out and warm air in. It’s an easy DIY project and a cost-effective alternative to replacing your windows.Keep the Warm Air Flowing Freely

Sometimes winter discomfort isn’t about a lack of heat—it’s about poor air circulation. Make sure your heating vents or radiators aren’t being blocked by furniture, rugs, or heavy drapes. Rearranging a room might not cost a dime, but it can greatly improve how effectively your home warms up. Similarly, use interior fans sparingly to help distribute warm air evenly if you feel certain rooms stay colder than others.

Make Use of Area Rugs and Mats

Cold floors are a common complaint in winter, especially if you have tile or wood flooring. Rugs do more than decorate—they provide insulation and help retain warmth. Add area rugs to high-traffic areas and anywhere your feet touch the floor frequently, like next to the bed or in front of the couch. Not only will it feel more comfortable underfoot, but it can also slightly reduce your heating needs.Store Your Seasonal Items with Purpose

When winter rolls around, there’s a natural shift in what you need within reach. Now is a good time to reorganize your storage. Pack away summer gear and make space for cold-weather necessities. When storing your winter items—whether it's extra blankets, coats, or holiday decor—choose airtight containers to prevent moisture buildup and damage. Smart organization now helps you avoid cluttering later and keeps your home functioning smoothly throughout the season.Take Advantage of Natural Sunlight

Sunlight is free, and it can help heat your home—at least during the day. Open curtains on south-facing windows to let in as much natural light as possible. Just remember to close them once the sun goes down to trap that warmth inside. This simple habit is completely free and works surprisingly well, especially in sunny climates or during those clear, chilly days.Wrap Your Pipes to Prevent Freezing

Frozen pipes can lead to costly and damaging repairs. One way to avoid this is to insulate your pipes, especially those located in colder spots like attics, crawl spaces, or near exterior walls. Foam pipe sleeves are affordable and simple to install. This one-time effort can prevent a lot of headaches later, and it can also help retain hot water longer, which is a bonus for reducing energy costs.Plan for Long-Term Savings

While the focus here is on affordable solutions, it’s also worth considering small investments that can pay off over time. Things like programmable thermostats, improved insulation, or storm doors may cost a bit upfront, but can significantly lower your heating bills year after year. Think of them as smart spending—not just added expense.Keep the Fireplace Efficient

If you have a fireplace, it can be a cozy addition to your winter setup—but only if used correctly. Make sure the damper is closed when not in use to prevent warm indoor air from escaping up the chimney. You might also consider a chimney balloon or inflatable plug to seal off drafts more effectively. Fireplaces can be charming, but they can also be energy sinks if not managed properly. Winterizing your home doesn’t have to come with a hefty price tag. With a bit of planning and some cost-effective strategies, you can stay warm and comfortable all season long without putting a strain on your budget. From sealing drafts to making the most of natural sunlight, each small effort adds up to big results. When you take the time to winterize your home properly, you’re not just protecting your space—you’re also investing in lower energy bills and a cozier living environment. So, as the temperatures start to drop, make the smart choice: winterize your home the affordable way and enjoy the peace of mind that comes with being prepared.Editorial | Knock, Knock - Pew, Pew

Americans are getting more trigger-happy by the day. In 2016, there were 37,077 deaths attributed to firearms. In the first quarter of this year, 13,386 lives were taken by a small object weighing around 8 grams. The country is on track to nearly double the number of casualties seven years ago.

This year alone, there have been 172 mass shootings. That number is 8% higher than the same period last year. As I type this, 13,386 have lost their lives to gun violence in 2023.

Two weeks ago, 16-year-old Ralph Yarl was shot twice, with bullets striking him in the left forehead and right arm, according to the Kansas City police department, by homeowner Andrew Lester. Lester, who is 84 years old, opened fire through a glass door with a .32 caliber revolver and is now facing two felony charges.

While Yarl survived the shooting and is recovering, 20-year-old Kaylin Gillis lost her life when 65-year-old Kevin Monahan, fired two shots from his front porch at a vehicle with three others in it in his driveway. Monahan has been charged with second-degree murder in the rural upstate New York incident.

In both cases, the shooters let lead fly without first saying a word to the victims.

Four days ago, an Instacart driver and her boyfriend were shot at 9 p.m. on Saturday in Southwest Ranches, Florida, while making their last delivery of the evening. Luckily, it was not the two teens were not injured by Anthonio Caccavale, who stated that he fired three times at the delivery car after the vehicle struck him.

Like the two earlier shootings, Diamond D'arville and Waldes Thomas were at the wrong address. Unlike the first two examples, the shooter will not be charged. NBC6 in Miami wrote the police said each party appeared "justified in their actions based on the circumstances they perceived."

Up in Lake County, Illinois, police charged 79-year-old Ettore Lacchei with murder after allegedly shot his neighbor, who was doing yard work on his own property. William Martys was using his leaf blower in his yard when he was fatally shot by Lacchei.

We are all for the right to bear arms. How about we work toward exercising it more responsibly as a country? It is time for America to figure it out.

Who knows? The next door you knock on might just get you killed.

Americans are getting more trigger-happy by the day. In 2016, there were 37,077 deaths attributed to firearms. In the first quarter of this year, 13,386 lives were taken by a small object weighing around 8 grams. The country is on track to nearly double the number of casualties seven years ago.

This year alone, there have been 172 mass shootings. That number is 8% higher than the same period last year. As I type this, 13,386 have lost their lives to gun violence in 2023.

Two weeks ago, 16-year-old Ralph Yarl was shot twice, with bullets striking him in the left forehead and right arm, according to the Kansas City police department, by homeowner Andrew Lester. Lester, who is 84 years old, opened fire through a glass door with a .32 caliber revolver and is now facing two felony charges.

While Yarl survived the shooting and is recovering, 20-year-old Kaylin Gillis lost her life when 65-year-old Kevin Monahan, fired two shots from his front porch at a vehicle with three others in it in his driveway. Monahan has been charged with second-degree murder in the rural upstate New York incident.

In both cases, the shooters let lead fly without first saying a word to the victims.

Four days ago, an Instacart driver and her boyfriend were shot at 9 p.m. on Saturday in Southwest Ranches, Florida, while making their last delivery of the evening. Luckily, it was not the two teens were not injured by Anthonio Caccavale, who stated that he fired three times at the delivery car after the vehicle struck him.

Like the two earlier shootings, Diamond D'arville and Waldes Thomas were at the wrong address. Unlike the first two examples, the shooter will not be charged. NBC6 in Miami wrote the police said each party appeared "justified in their actions based on the circumstances they perceived."

Up in Lake County, Illinois, police charged 79-year-old Ettore Lacchei with murder after allegedly shot his neighbor, who was doing yard work on his own property. William Martys was using his leaf blower in his yard when he was fatally shot by Lacchei.

We are all for the right to bear arms. How about we work toward exercising it more responsibly as a country? It is time for America to figure it out.

Who knows? The next door you knock on might just get you killed.

How to implement mixed metals in your next home renovation project

- Remember to pick two or more metals that are distinct from one another - perhaps picking one with a cooler tone and one that is warmer.

- Designate one metal for more prominent use and use the others as accents.

- Leverage fixtures and products that automatically provide a specific tonal look to complement the space.

More Sentinel Stories

Sentinel Prep Sports

Editor's Choice

Spartans' free throw shooting seals 53-40 regional championship win

Balanced scoring and ice-cold free throw shooting carried St. Joseph-Ogden past Bismarck-Henning 53-40 in Thursday's region...